In the violent shock wave of the collapsed credit bubble, the worlds biggest banks have been shredded, racking up over a trillion dollars of losses and cutting close to a quarter million jobs. But there bouncing in the chaos the smaller, Credit Suisse remains intact on it's own, while showing both it's hand and a plan. Simply put the modest bank may be seeking empire, an empire will be built on the rubble of the banks fiscal 2008 fourth quarter and full year ruins.

By the "well positioned comment Credit Suisse spins you past the writedowns and losses of 2008, directly to the presumtive promise of 2009. But there are no promises in a depression, no bank on the planet is well positioned going into 2009, but it is not 2009 that Credit Suisse is positioning for.

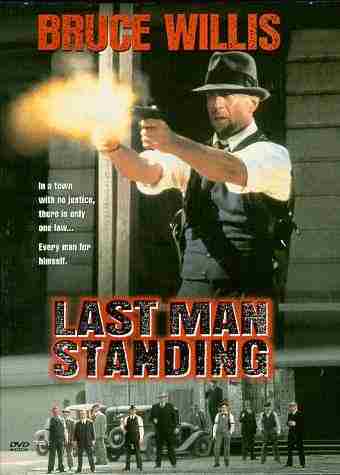

So there it is the simple plan for empire, play rope-a dope, run the clock, do what ever it takes to be the last man standing when the credit crisis finally ends. Is it realistic? Clearly management rationally believes it can be done and boldly believes they can do it. But before you rush to buy Credit Suisse shares remember that little Great Depression line about the best laid plans of mice and men. This Greatest Depression has just begun and likely to last a decade or more. Ten years is a long time to dance in the credit vacuum of a Greater Depression that any one alive has known or studied.

OK so Credit Suisse's accounting is as pure as they need to be, no more, no different than most banks. So how can we tell what they really think about their chances to span that little strech from depression to triumph; X-ray loan lose reserves.

Provision for credit loss was CHF 486 million ($413.7 million) for fiscasl fourth quarter 2008, up from CHF 131 million ($111.5 million) at the end of Q3 and CHF 203 million ($172.8 million) in the same period a 2007.

Well there it is provision for credit loss up up and away while revenue, dividends and expectations down. Credit Suisse can be the last man standing, but the credit crisis is a marathon not a sprint or a shoot out, to get there Credit Suisse must run not fast, but far.

Credit Suisse, the financial services company, on Wednesday reported a loss of 6 billion Swiss francs for the fourth quarter of last year but expressed cautious optimism for 2009, even as it cut some financial targets.No, that is the light on a freight train as that $7.1 billion loss came on write-downs of at least $2.72 billion.

The bank, whose loss was the equivalent of $7.1 billion, said that 2009 had started relatively well and that each of its divisions was showing a profit so far this year. It echoed upbeat comments from its larger Swiss rival, UBS, which reported the biggest annual net loss in the nation's history on Tuesday, 19.7 billion francs."We are well positioned going into 2009," the Credit Suisse chief executive, Brady Dougan, said at a news conference after the earnings announcement, adding that "this is not a 'light at the end of the tunnel' message."

The banks other two divisions, Private Banking and Asset Management joined the party bringing along the baggage of 407 million-franc ($341.9 million) related to auction rate securities and 599 million-franc respectively ($510.6 million).In Investment Banking, we reported a pre-tax loss of CHF7.8 billion. The result included net writedowns in the leveraged finance and structured products businesses of CHF 3.2 billion and significant trading losses.

By the "well positioned comment Credit Suisse spins you past the writedowns and losses of 2008, directly to the presumtive promise of 2009. But there are no promises in a depression, no bank on the planet is well positioned going into 2009, but it is not 2009 that Credit Suisse is positioning for.

Credit Suisse, which unlike crosstown rival UBS AG (UBS) hasn't accepted Swiss government assistance in coping with the financial crisis,It is to those Swiss and other tough regulators Credit Suisse won't answer nearly as much as the nationalized rivals.

Instead of accepting government help, Credit Suisse in October raised CHF10 billion from private investors to meet new, tougher capital requirements being introduced by the Swiss regulator

So there it is the simple plan for empire, play rope-a dope, run the clock, do what ever it takes to be the last man standing when the credit crisis finally ends. Is it realistic? Clearly management rationally believes it can be done and boldly believes they can do it. But before you rush to buy Credit Suisse shares remember that little Great Depression line about the best laid plans of mice and men. This Greatest Depression has just begun and likely to last a decade or more. Ten years is a long time to dance in the credit vacuum of a Greater Depression that any one alive has known or studied.

Unlike UBS, which is only now beginning to stanch massive outflows as wealthy clients exit, Credit Suisse's private bank has been largely resilient through the financial crisis, albeit posting lower revenue because of falling asset values and as clients unwind leverage.And less poetically the bank both blusters and bull sh!ts about it's level 3 cesspool. Here are the banks public comments on it's pure accounting methods, FAS 159.

Net new money in the unit was CHF2 billion for the quarter, which Helvea analyst Peter Thorne termed disappointing.

Credit Suisse's fourth quarter results come a day after its cross-town rival UBS AG posted record quarterly losses of 8.1 billion francs ($7.57 billion).Pure huh! Now check this Letter of Comment from Credit Suisse to the Financial Accounting Standards Boards regarding level 3 disclosure.

Unlike the larger bank, however, Credit Suisse chose not to take advantage of accounting rule changes that would have allowed it to value shaky assets at the price they would fetch at maturity, rather than at the current market price -- which can be lower.

"We have been extremely pure about keeping all of our accounting on a market-to-market basis," said Dougan, adding that it was important from a transparency point of view not to change accounting procedures during difficult market conditions

We generally support the requirement to disclose fair value measurements applying the levels withinthe fair value hierarchy to enable the reader of the financial statements to assess the valuation tech-niques and inputs used to develop fair value measurements of plan assets.It would be more revealing to mark the crap down to zero, pure and simple, but the bank complains of complexity . Now look at the way they disclose those toxins.

Paragraph 9b of the proposed FSP requires a reconciliation of the beginning and ending balances for fair value measurements of plan assets using significant unobservable inputs (Level 3) during the period, We disagree that such a separate and detailed disclosure ts useful for plan assets, and be-lieve it would create unnecessarily complex disclosure without adding sufficient benefit, Moreover, not all such information can be satisfied in a cost effective manner as our systems infrastructure and financial statement reporting processes do not currently track or reconcile this information in the manner requested. We therefore believe significant investments will be required to satisfy such a requirement. We would propose to remove the requirements of paragraph 9b

Illiquid leveraged finance and structured products assets as of end-2008 declined 53% from end-3Q08 and 87% from end-3Q07.That's what they reported in the press release and this is what they put on page 108 of the Q4 report.

Risk-weighted assets declined 31% from end-2007 and 15% from end-3Q08 to USD 163 billion as of end-2008 and are expected to decline to USD 135 billion by year-end 2009.

As of December 31, 2008 and December 31, 2007, CHF 3.0 billion and CHF 6.3 billion, respectively, of loans have been recorded at fair value, of which CHF 0.3 billion and CHF 5.7 billion, respectively, were classified as level 2 and CHF 2.6 billion and CHF 0.6 billion, respectively, were classified as level 3.Namely CHF 2.6 billion ($2.2 billion) of level 3 they had to spell out that they pure and simply did not want to.

OK so Credit Suisse's accounting is as pure as they need to be, no more, no different than most banks. So how can we tell what they really think about their chances to span that little strech from depression to triumph; X-ray loan lose reserves.

Provision for credit loss was CHF 486 million ($413.7 million) for fiscasl fourth quarter 2008, up from CHF 131 million ($111.5 million) at the end of Q3 and CHF 203 million ($172.8 million) in the same period a 2007.

Well there it is provision for credit loss up up and away while revenue, dividends and expectations down. Credit Suisse can be the last man standing, but the credit crisis is a marathon not a sprint or a shoot out, to get there Credit Suisse must run not fast, but far.

No comments:

Post a Comment