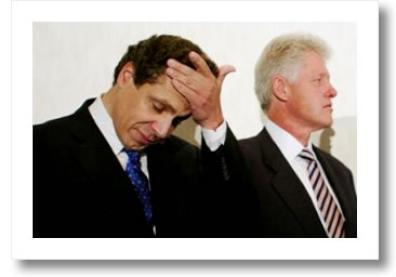

Andrew Cuomo grandstanding is paying some dividends as a AIG said that it will bail on a $10 million severance payment to a former bigwig. By now no one expects Cuomo to do the right thing for the right reason, but what's the difference? Well here it is, just as in the auction rate security case a grandstander of Cuomo's proportion will build an overwhelming case only to back off instead of going for the kill.

With the heat on, the big banks sat down with Mr. Cuomo to discuss his political ambitions and whether or not they would push back Spitzer style or behave more “amicably” like Thain. That’s where a deal was made in everybody’s best interests and what began as an aggressive investigation effective and punitive has morphed into a protect-the-big-banks sham.Cuomo by his own admission only recovered 18% of a possible $2 billion in that case, I think he should have gotten much more. Oh well he had plenty of CYA about working for the little guy, but it was just an excuse to back off, making things easier all around. Here it is from Bloomberg.

AIG Agrees to Withhold $10 Million From CFO Bensinger

American International Group Inc., following criticism by New York Attorney General Andrew Cuomo, won't honor a $10 million severance agreement with outgoing Chief Financial Officer Steven Bensinger, Cuomo said.

Cuomo met with AIG's new Chairman and Chief Executive Officer Edward Liddy today, the attorney general said. Liddy agreed to provide an accounting of all compensation paid to AIG's senior executives and assist in recovering any illegal expenditures, Cuomo said. The payments include those made to ex- CEO Martin Sullivan and Joseph Cassano, former head of the financial products unit for the New York-based insurer.

AIG, which received an $85 billion bailout by the U.S. government last month, also agreed to immediately cancel all junkets and perks, according to the statement jointly issued with the company.

``You had senior management who were rewarded with multimillion bonuses for good performances. How can you pay someone for good performance when their performance was anything but?'' Cuomo said in a conference call with reporters. ``If unjust compensation was paid and the company was undercapitalized, we believe we have reasonable grounds to capture funds.''

Cuomo said he had not yet determined the employment contacts were illegal or, to the extent they were, how much he will seek in terms of recovery. AIG agreed not to make payments pursuant to Bensinger's employment agreement in light of Cuomo's review.

Canceling Conferences

``We're reviewing everything and making an effort to identify activities that aren't critical and reviewing executive compensation,'' said AIG spokesman Nicholas Ashooh, declining to comment further on Bensinger.

The company will be canceling more than 160 conferences and events, some exceeding more than $750,000 per event, which Cuomo's statement will result in a savings of more than $8 million.

The company also will institute new expense management controls, Cuomo said, to prevent any other unwarranted expenditures.

David Herzog, 48, who was AIG's comptroller for three years, was promoted to replace Bensinger, the company announced today.

The company has been castigated by officials since it hosted a $440,000 conference at a California resort last month after agreeing to the federal bailout to avoid bankruptcy.

Cuomo, in a letter yesterday to AIG's board of directors, demanded the company stop ``extravagant'' expenditures and recover millions of dollars in unreasonable payments, or face legal action.

`Golden Parachute'

Cuomo cited a $5 million bonus and $15 million ``golden parachute'' AIG awarded its chief executive officer in March. Sullivan was AIG's CEO at the time.

The attorney general also noted in his letter that an unnamed top-ranking executive, ``who was largely responsible for AIG's collapse'' and was fired in February, was allowed to keep $34 million in bonuses. Cuomo said the executive also apparently continued to receive a $1 million a month from the company until recently.

The executive he referred to, Cassano, was head of AIG's financial-products unit until his retirement was announced Feb. 29. The business sold credit-default swaps, the contracts that plunged in value as the mortgage securities they guaranteed declined, causing more than $25 billion in writedowns at AIG.

Cuomo claimed in his letter yesterday that AIG's expenditures violated the state's debtor-creditor law.

Conference Call

In the conference call today, Cuomo said he had been in contact with Timothy Geithner, president of the Federal Reserve Bank of New York, about his AIG efforts.

Cuomo also said he might expand his probe to other companies with difficulties.

Federal loans to AIG rose to $82.9 billion from $70.3 billion, the Fed said today. The Fed agreed Sept. 16 to rescue AIG with an $85 billion loan in return for an 80 percent stake for the U.S. government and later said it would provide as much as $37.8 billion in additional liquidity to AIG.

No comments:

Post a Comment